Awesome Tips About How To Be A Debt Collector

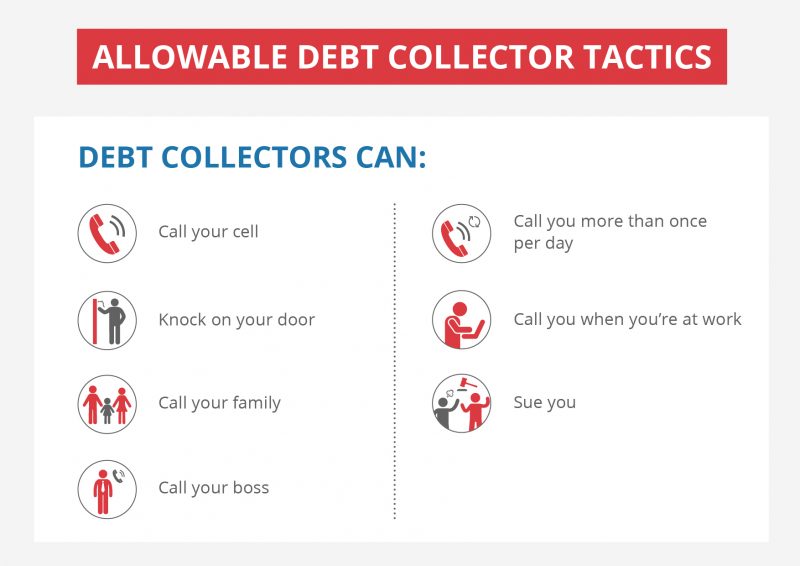

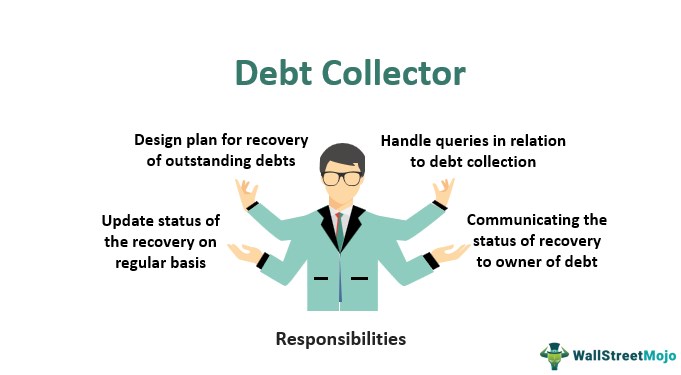

A debt collector must tell you the name of the creditor, the amount owed, and that you can dispute the debt or seek verification of the debt.

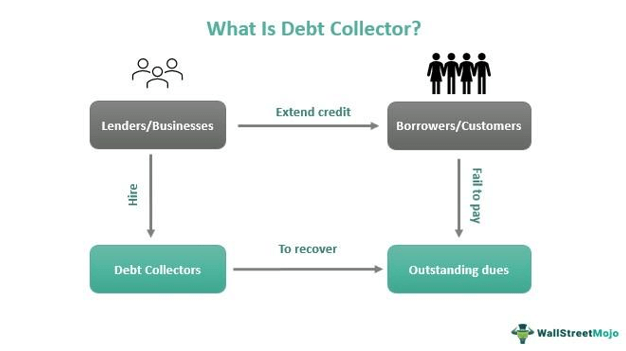

How to be a debt collector. Debt collectors can only take money from your paycheck, bank account, or benefits—which is called garnishment—if they have already sued you and a court entered a judgment against you. Tips for successful debt collections be prepared. For the first six months of your delinquency, you usually will deal with your creditor’s internal collector, which.

Answer the lawsuit, which you may have to do in writing or by showing up to court — or both. 8 hours agoin some cases, debt collectors make such allegations in debt collection lawsuits without having any factual basis for the allegations, and the allegations prove to be false. If that creditor says you have a zero balance, ask them to contact the.

They must be able to prove that the debt was transferred to them by someone else. The name of the debt collection company they work for; 1 day agocontact the doctor or hospital that says you owe them money to make sure you have an outstanding balance.

Consumer reports says you need to do some research and know how to fight back, if necessary. Clearly explain that it is a mistake. This debt collection management course will assist you or your staff to fully understand how to manage your clients who owe you money, ensuring your business always has a positive.

Here are the main steps to take if you get sued by a debt collector: The cfpb’s debt collection rule. Debt collection jobs continue to rise in popularity and in fact, the bureau of labor statistics reports the industry will grow by 19 percent within the decade.

Once the statute of limitations lapses, a creditor is generally prohibited from suing you to try and. The name of the original creditor; Though you can pursue a debt collector career with a high school diploma, earning.